The virtual office can be a suitable manner of running a BVI company for many investors. It is particularly advantageous because many BVI companies are structured to offer international services and do not rely particularly on a physical location, the business can be run from any other place while maintaining a registered office in the Islands as per the BVI company incorporation requirements.

In this article, our team of company formation agents answers some of the common questions about the virtual office and indicates the types of businesses for which it can be not only a suitable option but also one that is more cost-effective, compared to the traditional office.

| Quick Facts | |

|---|---|

| Best used for |

Offshore companies, start-ups, small and medium businesses that are not location-dependent |

|

Advantages of a virtual office in BVI |

A wide range of packages, the address of the virtual office in BVI can be used for incorporation purposes |

|

Registered address option |

Yes |

| Location |

Central and modern buildings in Road Town, Tortola, British Virgin Islands |

| Coworking spaces | Yes |

| Individual offices |

Yes |

| Meeting rooms |

Yes |

| Connectivity | High-speed Wi-Fi |

| Facilities in BVI | Mail and call forwarding, access to office and meeting room space, local phone number upon request as well as other optional subscriptions |

| Secretary services | Upon request, usually with premium packages |

| Local business telephone in BVI | Upon request |

| Rent duration | Monthly, biannual or annual contracts in most cases |

| Special packages/plans | Available upon request for additional office space, preferential access to meeting room space, dedicated secretary services and more |

| Approximate costs | Can start at $105 per month for basic packages |

| Change from traditional office to virtual office in BVI | Yes, aided by our experts in BVI |

What is the virtual office?

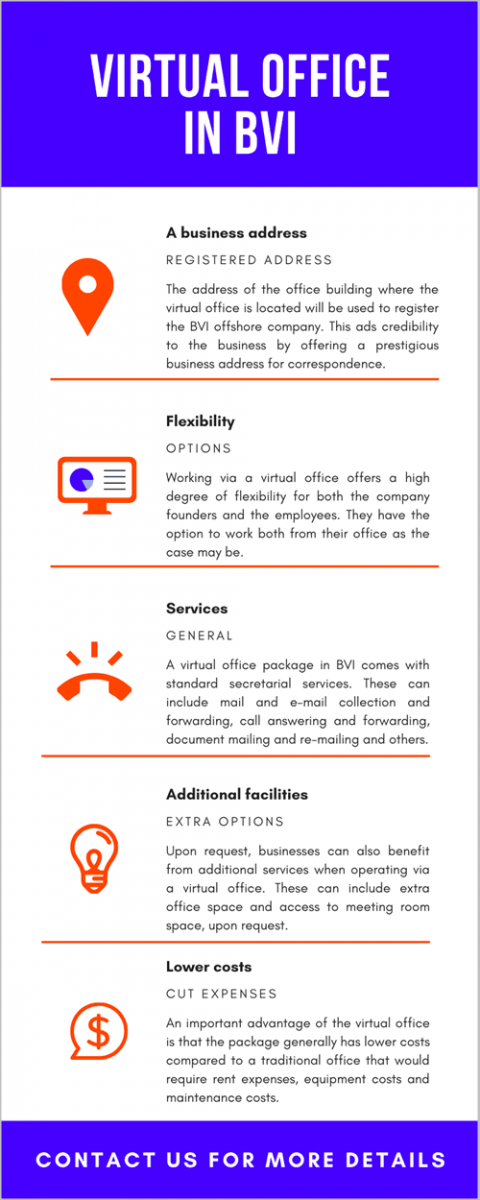

The virtual office is a physical address that can be acquired via a package from a provider, the business thus acquiring an address and a manner of running its activities in a flexible manner. This space will offer different degrees of office facilities and equipment and the team or the company representatives can choose to work either remote or from that location if the package is designed in this manner.

The virtual office is often a suitable way of establishing an offshore company precisely because of the flexibility it offers in terms of the workspace.

Investors who run their business through a virtual office can rely on the assistance provided by our lawyers in BVI for a number of legal issues, including but not limited to corporate and business matters. We assist our clients with legal advice and representation as needed for debt collection, tax, insolvency and, intellectual property matters, or employment and contract law issues, among others.

Is the virtual office a viable alternative?

The virtual office in BVI is comparable in terms of essential advantages with the traditional rented office space, at lower costs for maintenance. By using dedicated virtual office services, investors who open a BVI offshore company benefit from a string and credible business image.

This type of presence in the British Virgin Islands can be used by those who open an International Business Company that engages in international trading and offers international consulting services but it is compatible with virtually any offshore activity undertaken in this jurisdiction. If you are interested in setting up a company in Singapore, we can put you in contact with our partners – OpenCompanySingapore.com.

What are the main advantages of the virtual office for investors in BVI?

A company that operates through a virtual office in BVI will have a proper appearance on the market, identical to the situation in which the beneficial owners would choose to rent or purchase a dedicated office space. The BVI offshore company will have a dedicated address in the British Virgin Islands, complete with a local telephone number.

The virtual office services package can be used as early as during the first steps for BVI company incorporation when the new offshore establishes its presence and assigns a local address. We can also help you open a bank account in BVI for your local company.

The facilities offered in such a package include mailing and forwarding services and call handling services but are not limited to these basic functions and our local team of experts can provide tailored needs to offshore investors, depending on the particularities of the business.

Investors who open a company in BVI and decide to relocate here can obtain British Virgin Islands citizenship after a number of years.

What are some examples of a virtual office package in BVI?

A basic virtual office package in BVI will include the following:

- a local business address: this is mandatory because it is needed to register an offshore company; it will also serve as the correspondence address.

- mail and e-mail collection and forwarding: upon request, the business owners can have an agent receive their mail on their behalf and then forward it as directed.

- document mailing and re-mailing: an agent can also handle the process of mailing certain documents and re-mailing when needed.

- call handling services: a secretary can answer the calls and the business will have its separate line and local telephone number that can also be used when offering the business details, for example on business cards, for formal emails and other correspondence.

- call forwarding to a telephone number of choice: this is a useful feature as the calls received at the local telephone number in the British Virgin Islands can be redirected to a chosen number; this way, the business owners will not lose important calls even if they are not present at the virtual office location at all times.

Our team of BVI company incorporation specialists offers all of these services and an advanced virtual office package in BVI that also includes dedicated office space and meeting room space, as needed. A combination of services is also possible so that investors may personalize the virtual office services as they see fit and as best suited to their business.

Working via a virtual office has multiple advantages, from fewer costs related to renting and equipping an office space, to fewer costs for commuting as well as increased employee productivity in some cases. An offshore company in the British Virgin Islands can successfully implement this means of flexible working. Oftentimes offshore companies in the BVI engage in international trade and businesses and investors may need to set up the business I the shortest amount of time possible. A virtual office will also offer a set of advantages for this purpose: the investor or beneficial owner of the company will save the time needed to rent, equip and prepare an office space in order to run the business. The services included in a standard package are satisfactory for many entrepreneurs and the fact that the company has a prestigious business address as well as prompt and reliable call transfer and answering services will ensure that the business runs smoothly.

For most companies, the call handling service is of great importance, as they will need to establish a professional base in the Islands. The fact that the business has a local BVI telephone number is consistent with its business image. Moreover, the call answering and/or redirecting services ensure that no call remains unanswered when business partners or clients attempt to contact a local BVI business. It should be noted that this service is subject to certain working hours in the region. The calls can be recorded, as required by the company owners or as needed for future reference. We highlight the fact that this particular call answering service does not mean that one of our agents interferes in the business or makes statements. However, this can be discussed beforehand, and some calls may be handled as directed.

Apart from the communications services, which are included in the package, the virtual office also allows the client to gain access to a needed office space. Most international investors who are interested in BVI company formation will not be present at all times in the Islands. Therefore, it is justified to refrain from renting or purchasing a large office space that may only be used from time to time. With a virtual office package, a needed office or meeting room may be reserved only on those occasions when it will be used. This can be planned in advance as many virtual office providers will have more than one office type available.

Doing business in the British Virgin Islands

Working via a virtual office has multiple advantages, from fewer costs related to renting and equipping an office space, to fewer costs for commuting as well as increased employee productivity in some cases. An offshore company in the British Virgin Islands can successfully implement this means of flexible working. Oftentimes offshore companies in the BVI engage in international trade and businesses and investors may need to set up the business in the shortest amount of time possible. A virtual office will also offer a set of advantages for this purpose: the investor or beneficial owner of the company will save the time needed to rent, equip and prepare an office space in order to run the business. The services included in a standard package are satisfactory for many entrepreneurs and the fact that the company has a prestigious business address as well as prompt and reliable call transfer and answering services will ensure that the business runs smoothly.

The nature of an offshore business makes it particularly suitable for operating via a virtual office. Most foreign investors who start a company in the British Virgin Islands will offer international services and choose to set up the company here because of the favorable incorporation and taxation conditions. Some of the common uses of BVI offshore companies, for which a virtual office can be used, are the following:

- Trading company: the BVI offshore company is involved in import and export activities; a regional presence is required, however, the office does not need to be a large one and the communications services included in most packages suffice.

- Investment company: the BVI business is used to pool funds and distribute them to other investment vehicles located in other counties; the virtual office is suitable because the business does not require a large number of employees.

- Holding company: the BVI company is used to hold shares in other companies or assets; this is also a situation in which a virtual office is suitable because the related activities can take place remotely.

- Professional services: an individual who specializes in a certain field, such as business consulting, offers his services through a BVI company; using a virtual office is recommended; additional meeting room space may be purchased for client meetings.

The use of the offshore company is important when determining the need for a virtual office. Investors who have any questions can reach out to our team of BVI company formation experts.

We invite you to watch a short video about the BVI virtual office:

BVI company management

A BVI offshore company is not required to prepare financial accounts. However, companies do need to keep sufficient information in the transactions they enter into and provide, upon request and if needed, reasonable information on the company’s financial position at any given time. The common accounting documents that are kept include the basic ones, such as the income statement (expenses, revenue, profits and losses during the reporting period), balance sheet (assets, liabilities, etc.) and the cash flow statement (during the reporting period; can be used for comparison with the income statement).

An important feature to point out is that the accounting records to not need to be kept in the British Virgin Islands, as may be mandatory in other jurisdictions. Investors who open a BVI offshore company have the flexibility to determine where the documents will be kept and the address with be communicated to the registered agent.

There are no auditing requirements for companies in BVI and there is no requirement to file the annual accounting statements with the authorities or make them public in any manner (applicable in general to the company’s financial information).

The light accounting requirements, and the fact that the company’s board meetings do not need to take place in BVI, make it convenient for many types of companies to use a virtual office in BVI. This allows them to strictly manage the daily business activities, as needed, and use the amenities provided by the service provider, with no need for extra storage space for keeping company-related documents at the same location.

BVI company control

Investors who are interested in British Virgin Islands company formation have the option to appoint a nominee director and/or shareholders. This means that the company can be managed directly by the owner or directed by the nominee, an appointed third-party who acts according to a fiduciary agreement.

Below, our company formation agents summarize these two options.

The main advantage when managing the company through a nominee director is that the beneficial owner, the foreign investor, will keep his identity confidential. This can be useful for a number of reasons that may have to do with the taxation policies in one’s country of residence as well as personal reasons that may be related to one’s wish to keep his involvement in a company or a business field private. The nominee director would, in these cases, act as the company director, however, the beneficial owner would still be the one to make the business decisions and receive the due dividend payments. The relationship between the two parties can be decided through a fiduciary agreement and this can also include information on the nominees’ level of involvement in the company. For example, if the parties decide that this is advantageous or desirable, the nominee can have a certain level of decision in the company’s best interests and handle part of the decisions on behalf of the nominee. Thus, he would actually be involved in many of the company’s daily management and control activities.

Investors in BVI who wish to use a nominee director need to note the fact that the annual costs related to company management would thus be increased. Nominee director and/or shareholder packages are provided upon request and the prices differ, according to the chosen outside management company (the appointed nominee, for which there is an option to appoint either a company or an individual).

Investors should know that if they choose to work with a nominee director they are required to indicate this during the early company formation stages. The registered agent will be informed of this decision and will prepare the incorporation documents accordingly.

The nominee shareholder service works in the same manner, with another party being appointed as the official shareholder in the BVI offshore company, however, the beneficial shareholder signs a fiduciary agreement and the nominee will represent his best interests when showing up for annual shareholder meetings as well as for other decisions. Dividend distributions are also discussed between the two parties.

This type of management can be advantageous in certain business models. The beneficial owner can still be the one to sign and manage important business transactions if he is appointed as a “company representative” and fulfills this role, rather than the one of the company director.

You can reach out to our BVI company formation experts before you decide to incorporate if you need more information on how to appoint a nominee director or if you need to discuss this option further with one of our agents.

BVI statistics

As seen in this article, the British Virgin Islands is an attractive jurisdiction to base business and also one where investors can easily use a virtual office.

According to the Financial Services Commission, the number of incorporations in the jurisdiction remains stable, as reflected by the following numbers presented in the 2019 Q2 Statistical Bulletin:

- 396,932: total number of business companies in the Register as of June 30, 2019;

- 6,365: the number of incorporations in Q2 2019;

- 9,126: the number of incorporated business entities in Q2 2018;

- 7,214: the Q1 2018 number of companies that were incorporated.

When referring to the number of incorporated companies, the statistics include new business companies, private trust companies as well as foreign companies and continuations.

A virtual office is a viable option for many businesses in the British Virgin Islands that require a local business presence. With this type of package, the company is able to establish a professional presence in the Islands and improve its business image.

Please contact our BVI company formation agents for information about our fees for virtual office services and about our complete company incorporation packages in the British Virgin Islands.