The British Virgin Islands company formation process is a simple one, and this is one of the most important advantages for all investors who choose to open a company here. Our team of experts in company formation in BVI can help all clients interested in setting up companies in this jurisdiction.

The British Virgin Islands (BVI) are one of the most popular locations to open an offshore business. The Business Companies Act is the one governing company formation and defines the International Business Company, a legal structure similar to that used in other offshore jurisdictions.

| Quick Facts | |

|---|---|

| Types of companies |

International Business Company (IBC) |

|

Minimum share capital for IBC |

No |

|

Minimum number of shareholders for IBC |

1 |

| Time frame for the incorporation (approx.) |

2 working days |

| Corporate tax rate | N/A |

| Dividend tax rate |

N/A |

| VAT Rate |

N/A |

| Number of Double Taxation Treaties (approx.) | No tax treaties, only tax information exchange agreements (approx. 28). |

| Do you supply a Registered Address/Virtual Office? | Yes |

| Local Director Required | No |

| Annual Meeting Required | No |

| Redomiciliation Permitted | Yes |

| Electronic Signature | Yes |

| Is Accounting/Annual Return Required? | No, however, there are requirements for keeping reasonable records. |

| Foreign-Ownership Allowed | Yes |

| Any Tax Exemptions Available? | The IBC is complextely exempt form income tax, as well as taxes on dividends, interest, royalties, compensations, capital gains and others. |

| Tax incentives | The general exemption from income taxation can be seen as an incentive. |

|

Crypto-friendly jurisdiction |

Yes, the Financial Services Commission recognises crypto-focused funds. |

|

Special ICO/ITO regulation |

Not presently |

| Fintech preferred jurisdiction | The favourable regulatory framework and attractive tax environment are suitable for businesses that operate in the financial technology sector. |

| Preferred for Forex |

The British Virgin Islands is a preferred location to obtain licensing for Forex activities. |

| Special provisions for US investors |

The provisions of the FATCA apply |

| Registered agent |

Mandatory |

| Requirement for the registered agent |

Hold a company management licence or a general trust licence. |

| Registered agent services |

Provided upon request by our team. |

| Registered agent change | Possible, with the proper notice given to the BVI authorities. |

| Nationality restrictions on registered agents |

Not applicable. The registered agent needs, however, to be properly licensed according to the laws of the British Virgin Islands. |

| Reasons to open a company in BVI |

Zero income tax, no withholding taxes and no value-added tax, English is the official language and the currency is the US dollar. |

| Incorporation without being present in BVI |

Upon request, our team can act as a designated legal representative who will handle relevant steps in the incorporation process. |

| Assistance for investors who are not in BVI |

We provide complete assistance (through the aforementioned power of attorney) for general or specific purposes in the name of investors who are not present in the BVI. |

| Reasons to work with our team | Extensive experience in onshore and offshore company formation, highly focused on working with international investors. |

| When to contact us for incorporation | As soon as you decide to incorporate a BVI offshore company or as soon as you need additional details about the business requirements. |

The Islands are a British Overseas Territory in the Caribbean and an important advantage for foreign investors is that the primary language spoken in the islands is English. The two most important business fields are tourism and financial services, and the latter is primarily supported by the large number of offshore companies incorporated here.

We can list the following advantages for opening a BVI offshore company:

- a simple BVI company set up procedure: there are minimum requirements for the formation of a BVI company (one company director and one shareholder) and the incorporation process is a fast one.

- lack of corporate tax for companies: there is no corporate income tax and no capital gains tax on companies in the BVI.

- no special conditions on doing business: companies can be involved in banking, insurance, and other business fields.

- foreigners are allowed to open companies: there are no nationality restrictions applicable to foreign investors in the British Virgin Islands; the BVI company formation process is simple for foreigners;

- high degree of confidentiality for the company director and shareholder: there are no requirements for the details of the company founders or beneficial owners to be included in public registries.

BVI company formation

The BVI company incorporation procedures takes place as per by the British Virgin Islands Companies Act. This is the main legal resource that defines the conditions for doing business in the Islands and for the incorporation of the Business Company (BC), formerly referred to as the International Business Company (IBC).

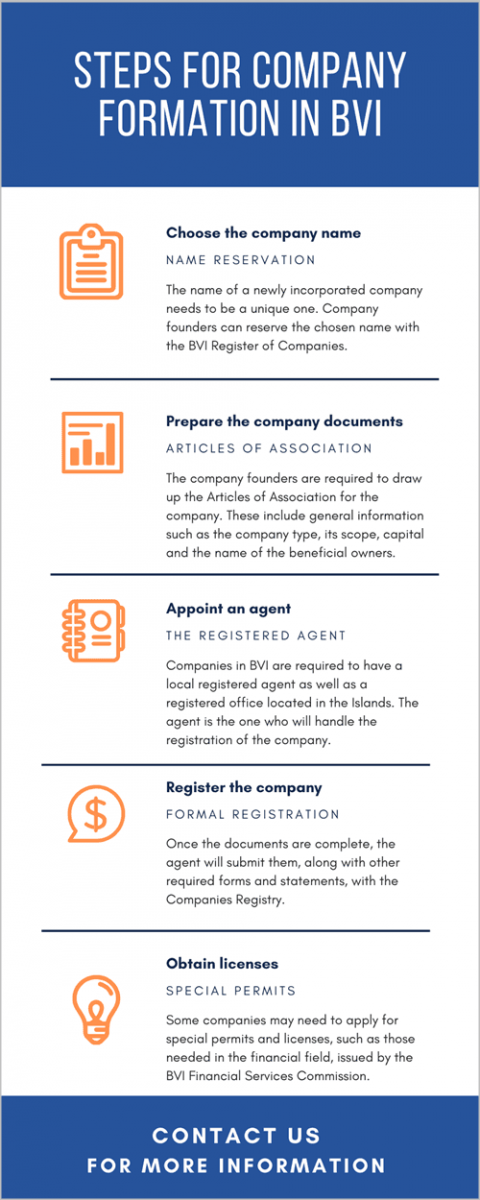

According to law, an offshore company in the British Virgin Islands must have at least one director and one shareholder. Our specialists in company formation in BVI can give you complete information on these conditions and those for the company officers. The six main steps for company formation in this jurisdiction are described below:

- Choose and reserve a company name with the Registry: this is done in order to ensure that each company has a unique name; the name will end with an abbreviation of the company type.

- Prepare the company documents: one of our BVI company formation agents can help you during this step when the company’s Articles of Association are created.

- Appoint a Registered Agent: this is required in the British Virgin Island and the details of the agent will be submitted when the company is incorporated.

- Pass on the documents for registration: all of the company documents, details about the founders (which are not made public) and those about the Registered Agent are submitted for registration with the Companies Registry.

- BVI bank account opening: this step can be performed before the company documents are drafted and it is a mandatory step for company incorporation.

- Acquire any needed special licenses: financial licenses for companies operating in this business field are obtained from the Financial Services Commission.

The BVI Commercial Registry issues information about registered companies in the British Virgin Islands for a small fee. The general information that is offered includes details about the registration number, the registered office and the date on which the legal entity was registered. Other details include the authorized capital and the status of the company.

Investors who want to set up a company in BVI should note that choosing the name for a new offshore company in the British Virgin Islands is subject to certain rules and also a number of restrictions. Our team specializing in BVI offshore company regulation lists some of these below:

- only companies that are licensed to carry out that particular business can use certain terms in the company name; these include the words bank, savings, trust, trust company, trust corporation or fiduciary, among others; this rule applies under section 16 (1) of the Banks and Trust Companies Act, 1990;

- a similar prohibition applies in the case of the terms insurance, assurance, underwrite and any combination or derivative of these terms; the rule applies under Section 75 of the Insurance Act, 2008; restrictions are also in place for the use of the words fund or mutual fund (likewise, these can only be used by licensed companies);

- limited companies are required to use one of the three accepted endings after the chosen and approved corporate name; these are “Limited”, “Corporation” or “Incorporated” as well as their short forms “Ltd”, “Corp”, “Inc” or “S.A.”;

- names that are identical or similar to those of companies that are already registered under the rules in force cannot be used;

- names that are considered offensive or objectionable by the Registrar cannot be used.

Companies in BVI can use a foreign character name and in this case the memorandum for registration will specify the fact that the company has a foreign character name in addition to its name and where the name of the company is inscribed in the Articles or the memorandum, the foreign character name will also be referenced. Companies cannot use this foreign character name and cannot be registered with it when the same character is already in use by a company registered under the Act or when the Registrar considers that the use of the particular name would be confusing or misleading. Our agents can provide you with complete details about the regulations for choosing a company name in the British Virgin Islands. We can also help you check the name if you are interested in BVI company formation.

The video below highlights the process of BVI company incorporation:

No taxes for offshore companies in BVI

The British Virgin Islands are amongst one of the oldest offshore company jurisdictions and have a legal framework for these types of companies that have been replicated by other tax havens. The Islands impose no corporate income tax for offshore companies, and this is a top advantage to all foreign investors.

Company director and shareholder protection in BVI

Company director and shareholder confidentiality are important for many foreign investors who are interested in company formation in BVI. Here, the information about company directors and shareholders is not disclosed upon the registration of the company and the public register is not available for public search.

Entrepreneurs in the British Virgin Islands have access to a number of corporate services, related both to the actual BVI company set up procedure as well as to the subsequent company administration.

Any foreign national is allowed to open a BC in the Virgin Islands. Investors have no restrictions on nationality and no restrictions on doing business. Those who are interested in setting up a company in another offshore jurisdiction, for example in Mauritius, can get in touch with our partners.

Company management in BVI

Foreign investors who want to set up a company in BVI should know that the director of the offshore company in BVI is the one who manages, supervises and directs the affairs of the company. There are no residency requirements for the directors and the number of permitted directors can be specified in the Articles of Incorporation. The main requirement is that the company must have at least one director. When a situation arises in which the company does not have a director for a certain period, then the manager or the supervisor of the company is the one who will take on the role of company director, as per the Companies Act.

Starting with April 2016, companies in BVI are required to keep an updated register of directors and they need to file copies of this register with the Registrar. However, investors should keep in mind that the directors are the ones to decide on how the registrar is formulated and, most notably, it is not publicly available. However, it contains information about the name and identification details for each of the corporate directors as well as the date on which they commenced their role (or, when their role ceased, as applicable). Newly incorporated companies are required to file the register within 21 days of the appointment of the first director. When changes take place in the management structure of the company, the legal entity is required to notify the change within 30 days (by filing an updated copy of the register of directors with the Registrar). Our specialists in company formation in BVI can give you more details on this matter.

The British Virgin Islands is a jurisdiction where the identities of the company directors can be protected by using nominee services, thus the actual company management process can take place in one of these two ways: the first situation is when the director is also the owner of the company; the second is when the director is not the beneficial owner but an appointed nominee.

In the first situation, the beneficial owner of the company is the one who takes all of the business decisions and signs all of the relevant documents. Moreover, his name will appear on all of the documents related to the formation of the company. Nonetheless, as stated above, the identity of the director is not made public in the registry, the name/names will appear in the company’s Articles of Association which are available publicly. The use of a nominee director is optional.

The nominee director is not the beneficial owner but has managerial powers through a fiduciary relationship. An agent occupies this position and acts out his duties as per the agreement with the beneficial owner.

In addition to the register of directors, a company is also required to keep a register of members. Investors who are interested in BVI company set up should know that the register will include information such as the names and addresses of members, the number and class of shares owned by each member. One of our agents specialized in company formation can provide more information about the register of members as well as the register of directors.

A requirement is in place for holding annual general meetings for BVI companies, however, this is a flexible requirement because there is no condition to hold the meetings in the British Virgin Islands. Moreover, as per the Business Companies Act 2004, the director’s meetings can take place by telephone or other electronic means as long as all of the participants to the meeting are able to hear each other.

Bank accounts in the BVI

It is common for investors to open a bank account in BVI when they incorporate the Business Company, the business form commonly used for offshore purposes. With some banks, the company directors will need to submit a set of documents that will be used for identification purposes. The company’s constitutive documents will also be required. One option is to open a bank account by using an approved intermediary. Our team of agents specialized in offshore company formation can help you with the BVI offshore company set up and the creation of the bank account. Our company formation packages can be tailored to the needs of investors to include bank account opening services.

Shelf companies in the BVI

Entrepreneurs in the British Virgin Islands have the option of purchasing a ready-made or shelf company. This is a legal entity which has already been registered in BVI or, alternatively, is ready for immediate registration. Investors can buy a ready-made company when they wish to save the time needed for BVI company set up. The shelf company also presents an important advantage: it has a later incorporation date and in some cases this can provide more prestige, such as in the case of a trading company. Investors can also purchase a shelf company if they do not have the time to propose a unique company name and want to use one that is already registered.

A shelf company may be a suitable option for many investors, however, before making the purchase, due diligence is required in order to make sure that the company is the most suitable option and that the company has no hidden debts and/or liabilities. Our team of agents specialized in BVI company formation can assist during this important step. We can analyze the following:

- – a general audit of the company’s situation, a review of the accounting documents and the existing records (if any, as many shelf companies are sold without having any commercial activity);

- – a review of any legal issues that the company may be facing in order to avoid any future claims against the said legal entity from third parties the buyer might have been unaware of;

- – any existing services agreements or client agreements that might have been concluded by the company during its existence (especially if this is an older legal entity, verifying the nature of any past collaborations, if any, is important).

These are just part of the verifications that can be performed by our team of company formation agents together with a dedicated team of accountants and legal specialists. We encourage investors who are willing to purchase a shelf company in BVI to reach out to us during this important step. Alternatively, we can assist those who want to set up an offshore company in BVI.

Companies with a longer shelf life can be used not only by investors who need to sign a contract and there is a condition for the corporation to have been registered for some time but also for obtaining corporate credits more easily. However, it should be noted that leases and credits for companies are awarded in BVI according to certain criteria that have to do with but are not limited to the company’s age and financial records. Our team can provide you with more details and information on how using a shelf company can be suitable for these purposes.

Finally, a shelf company can be a good option for investors who are looking for all of the advantages presented above and are also interested in acquiring a legal entity licensed for a particular business field. It is useful to note that some shelf companies may already have the licenses that are required in a certain field. This can be a very important advantage and one that will further reduce the time from the purchase to the first use of the company (in other words, investors can start trading right away in a business field that is regulated and where the issuance of a permit would require additional time).

Reasons to open an IBC in the British Virgin Islands

Investors interested in British Virgin Islands company formation have a number of benefits when choosing this jurisdiction for offshore company formation.

Among them we can include: no taxes on company profits, capital gains or inheritance, no value added tax and a convenient level of privacy for company directors.

Examples of common uses for a BVI offshore company (IBC) include:

- asset and intellectual property rights holding;

- e-commerce activities;

- IT actives;

- consulting services and many others.

Our partner lawyers in BVI offer counsel to foreign investors who wish to open an offshore company in the Islands. With their help, you can find competent answers to important questions concerning the company’s onshore and offshore business activities, international laws concerning foreign account tax compliance (FATCA, for US citizens), as well as many other issues.

The particularities of the IBC in the Virgin Islands

The type of company used in the British Virgin Islands by foreign investors is the International Business Company. This legal entity is sometimes referred to simply as the Business Company or BC. It requires at least one director and one shareholder and they can be natural or legal individuals. There are no restrictions on the nationality of investors.

The following table includes the main traits of the BVI IBC which are also important advantages for all foreign investors interested in opening an offshore company in BVI.

| Characteristic | Details |

| Non-resident director | This is permitted, there are no restrictions on the nationality of the company directors. |

| No taxes | The BVI is exempt from the income tax in the Islands and from any taxes on dividends, interest or royalties. |

| Legal personality | The BVI has legal capacity and powers and what’s more, it also has a flexible structure. |

| No accounting obligations | There are no mandatory requirements for preparing or filing the annual financial accounts. |

This type of company has no requirements for a paid-up capital and it can be paid partly or fully upon incorporation. Standard values for the authorized capital are used in practice. As far as the lack of accounting obligations are concerned, while there are no annual filings and reports, the company must keep a record of its transactions. One of our agents who specialize in BVI company set up can give you more details.

The public disclosure of the beneficiary owners/s of the company, as well as that of the shareholders and directors, is not mandatory – an important advantage for foreign investors who wish to maintain their anonymity while conducting business in the British Virgin Islands. Their identities will be known to the Registered Agent who will also update the information about the beneficial owners, as needed. However, investors can keep in mind that this information is not disclosed publicly at any time.

Regulated and restricted companies in BVI

The Financial Services Commission is the regulatory company for entities in selected business fields. Banking and fiduciary companies, insurance companies as well as insolvency practitioners and registered agents are considered regulated entities. The Commission maintains an updated list of these entities that can be accessed by the public as well as other market participants.

Another type of legal entity is the regulated purpose company (RPC). These business forms include specific information in their Memorandum that limits their purposes. In most cases, these companies are used for structured finance transactions or they are created for the sole purpose of holding certain types of assets. Investors should note that these types of companies must state their limited scope as soon as they are incorporated. The certificate of incorporation issued for this specific type of business will expressly state the restricted purposes for which the company is used.

Our team of BVI company incorporation agents can offer more details about regulated companies as well as the RPC company.

The following situation regarding the number of companies was applicable at the end of 2018 as per the Statistical Bulletin issued by the Financial Services Commission:

- – 9,126: the number of business companies, private trust companies, and foreign companies in Q2 2018.

- – 9,789: the number of legal entities in Q1 2018;

- – 7,621: the number of companies in BVI in Q2 2017.

According to the same Bulletin, the number of new company incorporations in BVI in the second quarter of 2018 increased by 19.75% in 2018 compared to the same period in 2017.

According to business type, the most popular business form is the company limited by shares, accounting for 99% of all the Business Companies in BVI. The rest are unlimited companies without an authorization to issue shares as well as unlimited companies authorized to issue shares.

Contact our local company incorporation agents for complete information about the process of opening an offshore company in BVI and its characteristics.